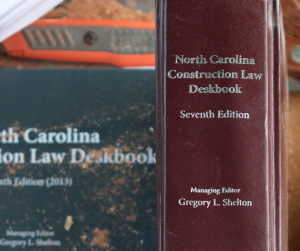

By Gregory L. Shelton

Shelton Law Carolinas

(704) 940-9012

The purpose of this pamphlet is to provide a summary of the rights available under North Carolina’s construction lien law. This pamphlet covers the basics of the lien law and is not intended as a comprehensive guide to North Carolina’s mechanic’s lien law.

What is a lien?

In the context of North Carolina construction projects, a person (or company) who furnishes labor or materials for the improvement of real property has the right to assert a claim against the property to secure payment. Subcontractors and suppliers may also assert a lien against the construction funds by serving a “Notice of Claim of Lien on Funds.” Lien rights that are not “perfected” according to specific requirements, and within statutory time limits, will be lost forever. If you are concerned about losing your lien rights, you should consult a lawyer knowledgeable of the lien law without delay.

A lien that is perfected may ultimately result in the sale of the property by the sheriff to obtain funds to pay for the work. Such sales are the exception rather than the rule. In most cases, the lien claimant will be paid in full or in an agreed-upon amount in exchange for canceling the lien.

How Do I Perfect a Lien Upon the Property?

The lien is “perfected” by filing a legal document with the clerk of court in the county where the project is located. The lien document, called the “Claim of Lien on Real Property,” must correctly describe the property interest involved, the parties to the transaction, and the required information. The “Claim of Lien on Real Property” is enforceable by the general contractor (defined in the lien law as the party who contracted directly with the owner) or by a party standing in the shoes of the general contractor through subrogation (see section below dealing with subcontractors). If the “Claim of Lien on Real Property” is incorrect, the court may refuse to enforce it.

To perfect a lien on the project, you must file the “Claim of Lien on Real Property” in the county where the project is located within 120 days of the last day that you (the general contractor) furnished labor or materials to the project. You must then file a lawsuit to enforce the Claim of Lien on Real Property within 180 days of the last day that you (the general contractor) furnished labor or materials to the project. In many cases, the claim will be paid or settled before the 180 day deadline to file the lawsuit expires.

How Do I Perfect a Lien Upon Funds?

If you performed work as a subcontractor or supplier of any tier, you may assert a lien upon the contract funds in the hands of the owner, the general contractor, or anyone else above you in the contractual chain. The lien upon funds is perfected by serving a legal document called a “Notice of Claim of Lien Upon Funds.” This document, which is served upon the owner, the general contractor, and any other subcontractors above you in the contractual chain, must comply with the statutory requirements, and must be served by the sheriff, by certified mail (return receipt requested), or by an authorized overnight delivery service.

The law requires the recipient of the Notice of Claim of Lien Upon Funds to hold funds sufficient to pay the amount claimed. A recent decision by the Supreme Court of North Carolina suggests that the recipient may not release any project funds. If the recipient fails to hold funds after receiving the Notice of Claim of Lien Upon Funds, he may be personally liable to the lien claimant to the extent of the wrongful payment.

May a Subcontractor or Supplier Assert a Lien Upon the Property?

The law permits a subcontractor or supplier to assert a lien upon the property through a legal concept known as “subrogation.” Through subrogation, the subcontractor or supplier “stands in the shoes” of the general contractor with respect to the direct lien upon property. For example, if the owner owes the general contractor $10,000, the subcontractor or supplier asserting the subrogated lien may assert a claim of lien upon the property up to $10,000. To perfect a subrogated lien upon real property, the lien claimant must attach a copy of the Notice of Claim of Lien Upon Funds as an exhibit to the Claim of Lien Upon Real Property, and must satisfy the perfection requirements described above in “How Do I Perfect a Lien Upon the Property?”

Do I Need a Lawyer?

In most cases, a lawyer experienced in preparing and prosecuting lien claims will add value to the process. North Carolina’s lien law is found the statute books, the case reporters, and the state constitution. To complicate matters further, North Carolina courts sometimes require strict compliance with the forms and procedures governing the various types of liens. Finally, if the lien claimant is not a person, a lawyer will be required to perfect a lien upon property because companies may not represent themselves in court.

What is a Payment Bond?

On government projects, and on many private contracts, the owner requires the general contractor to purchase a payment bond. The payment bond is a contract entered by the general contractor and the surety company which gives subcontractors and suppliers the right to demand payment directly from the surety company. The surety company owes the subcontractor or supplier (the “Claimant”) an independent duty to investigate the Claimant’s demand for payment. If the surety company determines that the Claimant is entitled to payment, the surety company must make direct payment to the Claimant. After making the payment, the surety company can demand that the general contractor reimburse (“indemnify”) the surety company.

How Do I Make a Payment Bond Claim?

The steps you must take to assert a claim against a payment bond are contained in the payment bond and, on government projects, under the laws of North Carolina. You must obtain a copy of the payment bond to learn the name and address of the surety company and the procedural steps that you must take to preserve your rights. In many cases, you will not be told that there is a payment bond. You must ask, in writing, for a copy of the bond.

If you decide to make a claim against a payment bond without the assistance of an attorney, you should pay very careful attention to the numerous notice requirements and deadlines contained in the payment bond and in the applicable statutes. Surety companies may deny your claim if you fail to satisfy the often confusing technicalities contained in the payment bond.

© Gregory L. Shelton 2011